Introduction

In 2025, managing money is smarter and easier than ever. With AI-driven insights, automation, and real-time analytics, these apps help users save, invest, and grow wealth efficiently. Here are five standout finance apps of 2025.

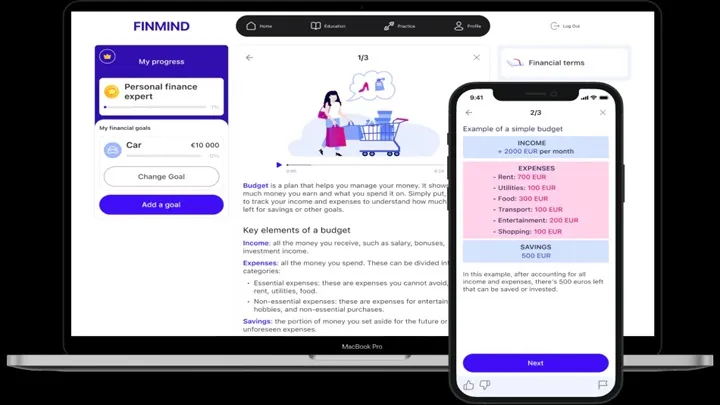

1. FinMind AI – Your Smart Financial Advisor

Category: Personal Finance Management

FinMind AI helps users take control of money with:

- AI-driven budgeting and spending insights

- Smart bill reminders and goal tracking

- Real-time cash flow analysis

- Personalized saving suggestions

- Integration with all bank accounts and cards

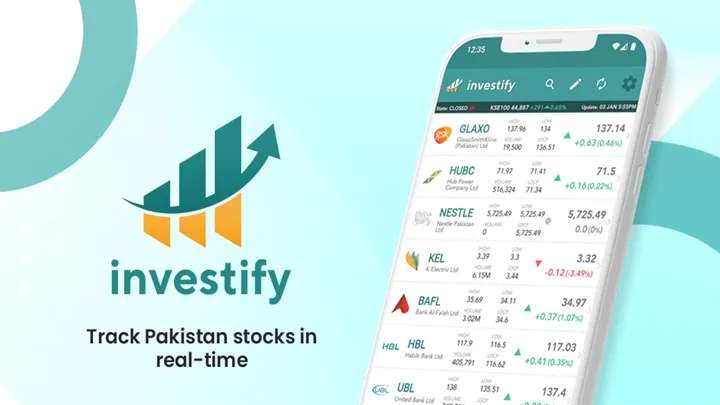

2. Investify+ – Smarter Investing for Everyone

Category: Investments & Stocks

Investify+ makes investing simple through:

- AI portfolio recommendations

- Real-time stock, crypto, and ETF tracking

- Fractional share investing

- Market news with sentiment analysis

- Risk management and goal setting tools

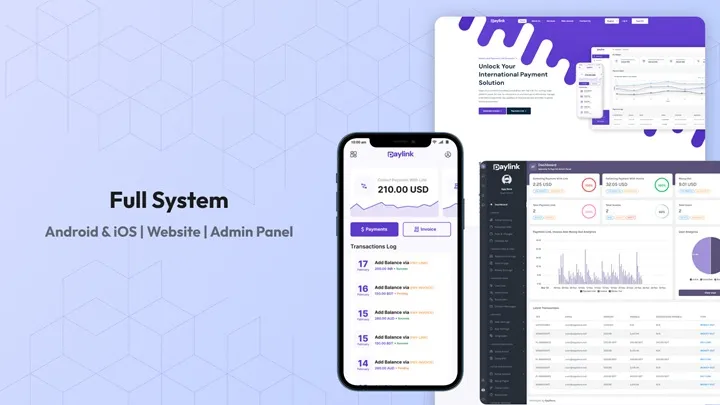

3. PayLink 360 – All-in-One Payment Hub

Category: Digital Payments

PayLink 360 simplifies transactions with:

- Global payments in any currency

- Smart bill-splitting and auto-tracking

- One-tap QR and NFC transfers

- Cashback and reward programs

- Built-in fraud detection system

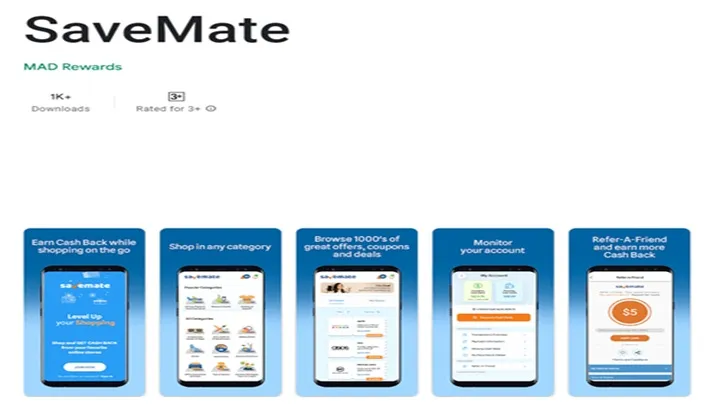

4. SaveMate – Everyday Savings Assistant

Category: Saving & Budgeting

SaveMate helps you save effortlessly by:

- Automatic round-up savings from purchases

- AI-based spending habit analysis

- Smart savings challenges

- Integration with loyalty and coupon apps

- Goal tracking with visual progress charts

5. CryptoSphere – The Future of Digital Assets

Category: Cryptocurrency & Blockchain

CryptoSphere empowers digital investors with:

- Real-time crypto portfolio tracker

- Secure wallet with biometric protection

- AI market predictions and alerts

- NFT marketplace integration

- Multi-chain support for global trading

Conclusion

The Top 5 Finance & Investment Apps of 2025—FinMind AI, Investify+, PayLink 360, SaveMate, and CryptoSphere—use AI, automation, and real-time data to help users manage, save, and grow their money with confidence.